Welcome to my comparison between Melio Vs PayPal.

When I eventually established myself as a freelancer and made a fair profit, I realized I had to register for a reliable web-based payment platform with extensive testing. As I didn’t want to, I didn’t go to the bank every week to deposit or withdraw money for my freelance work.

And because there are so many other online payment processors (like Melio and PayPal), I knew I had to look into each one to see which was better because there are so many other online payment processors.

If you’re curious to know how PayPal and Melio stack up against one another, this article will assist you in choosing which of these two web-based payment services is ideal for you and your business. Online payments are accepted by both Melio and PayPal.

Bottom Line Upfront

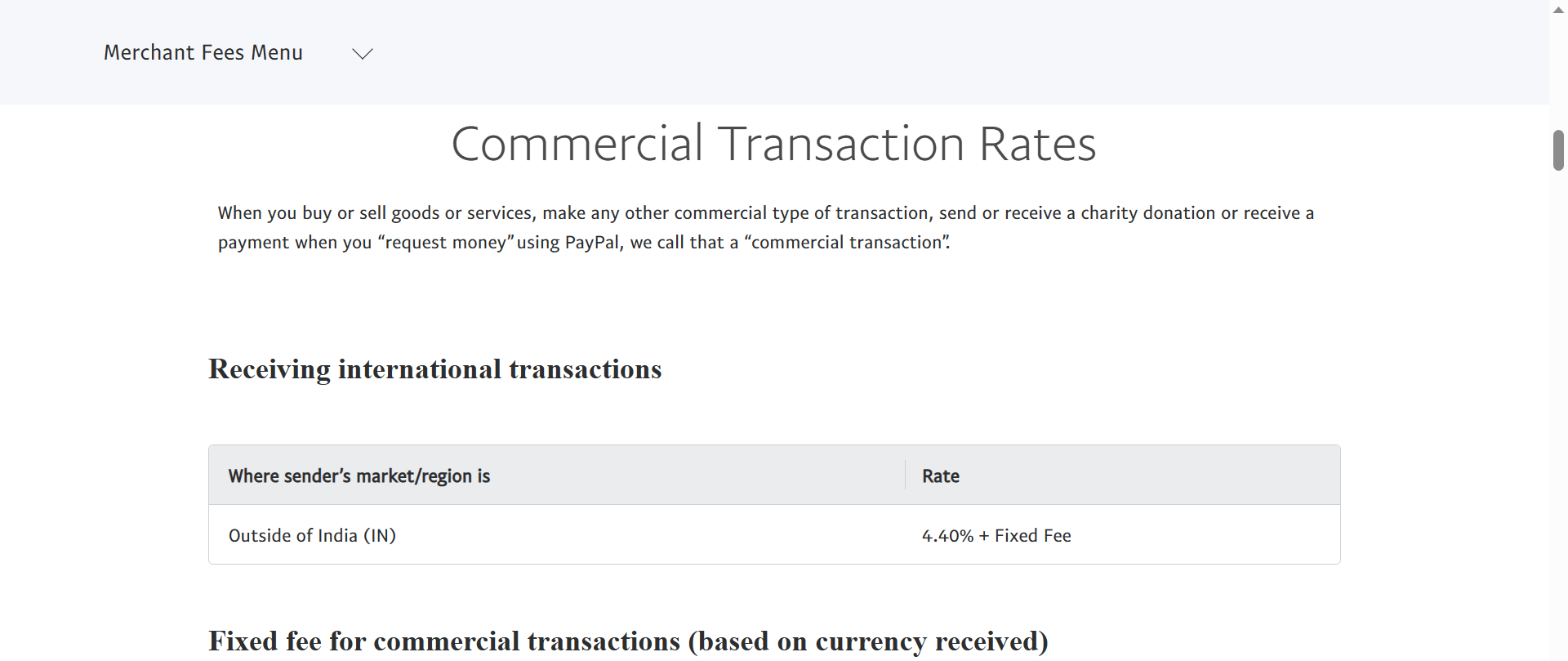

PayPal is still the most popular choice for overseas payments and transactions where a third party must act as the taxing authority.

Melio is the finest alternative for sending and receiving payments within the United States, both for sending and receiving invoices. Less complicated and less expensive than PayPal.

Melio is a free online payment service that lets you use your bank account, debit card, or credit card, while PayPal is an online shopping cart that lets you send and receive payments.

Melio Vs. PayPal: Overview

Melio

Melio is a free-to-use online payment platform for sole proprietorships, partnerships, and independent contractors that was introduced in 2018. You will be given the option to choose between Melio Business or Melio Accountant when you sign up for Melio.

Your online payments, whether made with a credit card, debit card, or bank transfer, are simple to manage with Melio. To any address you give Melio, they can send a paper check (also known as an Automated Clearing House, or ACH, bank transfer), and the check will reach its destination within a week.

Melio’s main objectives are to lessen administrative burdens and increase cash flow. The most significant characteristics that Melio provides are listed below:

- User-friendly invoicing and reporting.

- Manually add vendors and billing information.

- Upload images and documents to their platform.

- Centralized dashboard.

- Duplicate payment notification.

- Track payments in real time.

- Automated data synchronization.

- Automatically syncs with QuickBooks.

- Automatically sends out checks on your behalf.

Leave a Comment