Welcome to my comparison between Melio Vs PayPal.

When I eventually established myself as a freelancer and made a fair profit, I realized I had to register for a reliable web-based payment platform with extensive testing. As I didn’t want to, I didn’t go to the bank every week to deposit or withdraw money for my freelance work.

And because there are so many other online payment processors (like Melio and PayPal), I knew I had to look into each one to see which was better because there are so many other online payment processors.

If you’re curious to know how PayPal and Melio stack up against one another, this article will assist you in choosing which of these two web-based payment services is ideal for you and your business. Online payments are accepted by both Melio and PayPal.

Bottom Line Upfront

PayPal is still the most popular choice for overseas payments and transactions where a third party must act as the taxing authority.

Melio is the finest alternative for sending and receiving payments within the United States, both for sending and receiving invoices. Less complicated and less expensive than PayPal.

Melio is a free online payment service that lets you use your bank account, debit card, or credit card, while PayPal is an online shopping cart that lets you send and receive payments.

Melio Vs. PayPal: Overview

Melio

Melio is a free-to-use online payment platform for sole proprietorships, partnerships, and independent contractors that was introduced in 2018. You will be given the option to choose between Melio Business or Melio Accountant when you sign up for Melio.

Your online payments, whether made with a credit card, debit card, or bank transfer, are simple to manage with Melio. To any address you give Melio, they can send a paper check (also known as an Automated Clearing House, or ACH, bank transfer), and the check will reach its destination within a week.

Melio’s main objectives are to lessen administrative burdens and increase cash flow. The most significant characteristics that Melio provides are listed below:

- User-friendly invoicing and reporting.

- Manually add vendors and billing information.

- Upload images and documents to their platform.

- Centralized dashboard.

- Duplicate payment notification.

- Track payments in real time.

- Automated data synchronization.

- Automatically syncs with QuickBooks.

- Automatically sends out checks on your behalf.

PayPal

In the field of online digital payments, PayPal is usually considered the leading online payment system. The business was founded in 1998. PayPal has 429 million users and still adding new ones as of the second quarter of 2022.

You can send and receive money, as well as make payments and transfers, on the secure and dependable platform offered by PayPal. The fact that you are not compelled to disclose or share your personal financial information with anyone who sends or receives money from you using the service is one of the most alluring features of PayPal.

Here is a quick rundown of some of PayPal’s most significant features:

Payment card industry (PCI) compliance reduces security breaches. The “Bill me later” option. Online billing. Barcode scanning. Shopping cart capability. Mobile card reader. User-friendly mobile app. Express checkout. Inventory tracking.

Melio Vs. PayPal: Pricing

Melio

Melio provides two distinct service options: Melio Business and Melio Accountant. Both of these options live up to their billing and offer equivalent advantages. There are no hidden fees or recurring charges associated with their service.

The only action that costs money is using a credit card to send or receive money. Since it represents only 2.9% of the total, its price is very modest.

PayPal

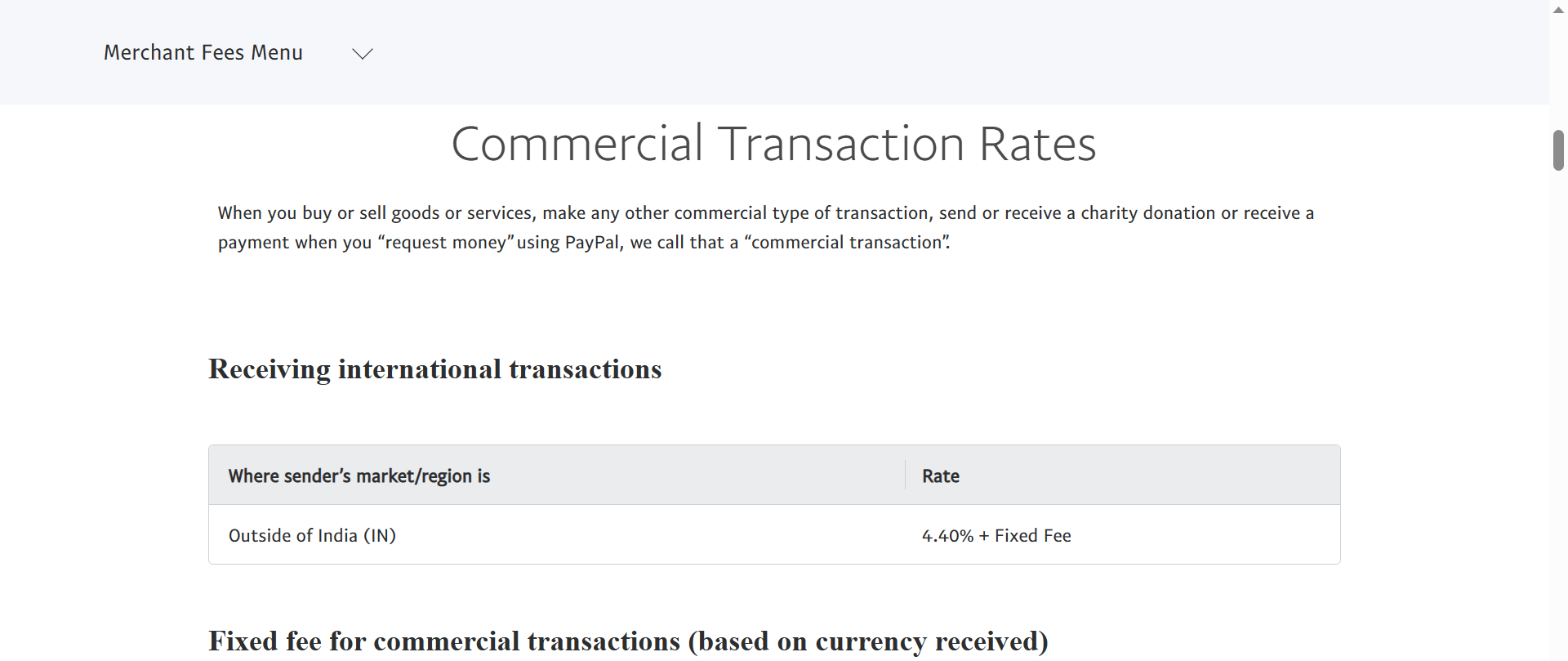

PayPal is a free service that you can use to make purchases or perform other types of commercial transactions. A fee will be charged if currency conversion is required to make payments in a different nation. No fees are associated with opening a PayPal account; neither monthly nor yearly maintenance fees are assessed.

If a transaction results in a charge, PayPal will let you know. The list of the main charges made by PayPal is as follows:

- If you receive money due to an online transaction, you will be charged a fixed cost of 30 cents (in the US) and a currency conversion fee equal to 2.9%.

- Any overseas transactions will be charged an additional fee of 1.5 percent.

- A 5% fee, up to a maximum of $4.99, must be paid if you intend to send money to a person or business outside the United States.

Melio vs PayPal: Billing & Invoicing

Melio

Melio streamlines and generally clarifies the billing and invoicing process:

- To import your invoices, sync them with the accounting software you use, such as QuickBooks, or manually import them (it only takes a few clicks).

- Distribute your payment demands (which you can edit and brand). Please add a “pay” button and an attachment of your invoice.

- Your client can now select the “pay” button at this stage.

- The transaction will go through without any issues.

PayPal

PayPal makes it easy to send invoices to clients and collect payments. If I could give you any advice, it would be to make sure you select the right payment option because different merchants will charge you differently.

Just stick to these simple instructions to invoice and bill customers:

- Open your PayPal app or account and click the “Request” button under the menu.

- Select one of the following from the available options:

Create a PayPal link to send to the customer, split a bill, create an invoice, and enter the email or phone number of the payer.

- If the other party enters your email address or mobile number in the “To” field of the transaction, they can transfer your money.

- Through the PayPal app, you will receive an email confirming the receipt of payment.

- You can decide whether to put the money in your bank account or retain it on hand to utilize in future transactions.

Melio vs PayPal – Customer Support

Melio

For both of its paid subscription plans, Melio Business and Melio Accountant, live customer support is available. With the Accountant Plan, you get access to actual accountants who can assist you with any questions or issues that might crop up. Another convenient way to contact Melio is by connecting with them on their social media platforms, like Facebook and Twitter.

Check out Melio’s website’s “Frequently Asked Questions” (FAQ) page for answers to common queries for a helpful tip.

Melio is very proud of the strict security procedures it employs. This web-based platform secures user data by encrypting and storing it in data centers that have undergone audits and are manned round-the-clock by security personnel.

Melio uses TabaPay, a third-party credit card processor, as an additional layer of security. Trust and Evolve Bank will also ensure that your money and checks are securely delivered to your vendors. Each employee is subjected to a screening process, and security training is necessary for everyone.

PayPal

PayPal is renowned for offering top-notch customer support and upholding a secure infrastructure. Although these options aren’t always available, PayPal offers customer care via email, phone, live chat, and a help center. You can find answers and solutions to more general issues using the available community forum. You may contact PayPal using social networking sites like Facebook and Melio.

A helpful tip is that you will receive better customer support from a service provider (like Melio or PayPal) the longer you remain a customer.

PayPal has guaranteed that its users are safe from fraud and hackers in terms of the platform’s security. PayPal does not display any bank account or payment card details on the platform.

The procedures PayPal uses to guarantee that its users have a good and secure experience using their platform are listed as follows:

Transactions only require your username and password; they protect against merchant fraud; they hold transactions with issues or disputes until they are resolved; they use sophisticated encryption techniques to secure transactions; and they continuously track all transactions.

FAQs: Melio Vs PayPal

Who can use Melio?

Anyone who wishes to use Melio can do so, regardless of their status as a distributor, supplier, small business owner, or independent contractor. Melio can be used to make requests and send money domestically and abroad.

Is PayPal safer than a bank transfer?

Using PayPal is a considerably more secure method than sending money through a bank transfer. Using PayPal does not require you to physically carry cash or provide them any of your financial information, in contrast to a bank transfer. For your security, each transaction is encrypted, and the system is constantly watched.

Also, Read:

Conclusion: Melio Vs. PayPal: The Ultimate Winner

Along with their many excellent features, Melio and PayPal have some obvious flaws that need to be ironed out. I could choose the one that would work the best for my freelance writing business by comparing these two well-known payment platforms.

Due to Melio’s support for many payment options, such as ACH bank transfers, credit cards, and debit cards, my customers may pay me more conveniently.

My preferred payment option is PayPal since it helps me with my taxes and provides additional merchant possibilities, which are advantageous to my little freelance business.

Compared to Melio, PayPal has been around for much longer and today has more than 429 million active accounts. I’ve concluded that I need to hire a bookkeeper due to expanding my business.