Are you looking for a comparison between Melio vs Stripe? Don’t worry, I got you covered.

To receive payments and issue bills, a reliable payment service is essential. Stripe Payments & Melio are excellent choices for eCommerce payment processing, but they have unique quirks.

I understand firsthand how challenging it is to keep track of invoices & payments when a firm grows. When you start doing business globally, things grow more complex.

I put them through their paces to provide an unbiased evaluation of Stripe and Melio. You can compare their support, features, and costs to choose the ideal for your needs.

Melio Overview

Melio is an internet-based bill payment service. Freelancers and independent contractors can be paid through this system, which can also be used to charge clients. Integration with Quickbooks and other popular accounting software is straightforward.

My experience with Melio has led me to believe that it is an excellent choice for use in organizations of a more manageable size, particularly those who are searching for a system that is uncomplicated and easy to navigate.

For more information, Read Melio Review.

Stripe Overview

Stripe is a payment processing service that helps merchants take payments for selling both physical and digital products and create subscription services.

Stripe Payments is the company’s monetary transaction module. It’s an excellent solution for enterprises with in-house engineers because it is flexible.

Any business, regardless of size or complexity, would benefit from implementing Stripe, but those with more time on their hands would do well to do so.

Related – Melio vs Plastiq – Which is a Better Choice for Your Needs?

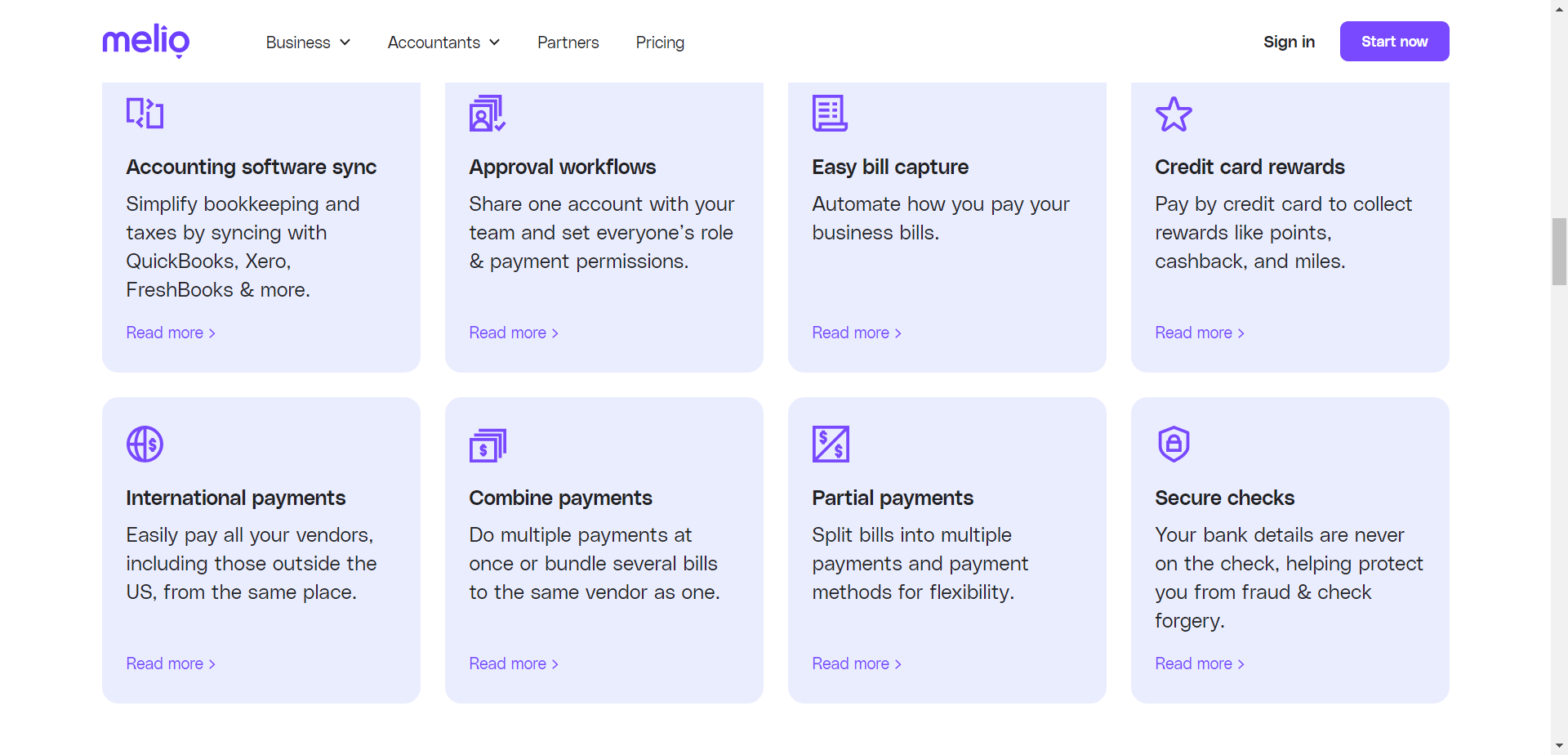

Melio Features

Let’s start with Melio’s Key Features.

Contact Management

Using Melio to organize your contacts is a breeze. You can see who you work with, add new connections, and import existing contacts from accounting software. Connecting with freelancers, clients, or clients is as simple as clicking a few buttons.

International Payments

Your overseas suppliers will not need an account with Melio to get paid from your dashboard.

Financial transactions in US dollars and batch payments are both supported.

It’s important to remember that the payment processing cost is always $20, no matter how much money you’re sending. This is especially important for organizations with a lower turnover rate to remember.

Melio’s international payment options are extensive.

Making Payments

Melio is a payment option. Keeping track of this is less hassle if you often pay independent contractors or freelancers.

The Pay inbox can be linked to billing and accounting systems. After that, you can send money via bank transfer or card without the recipient even needing a Melio account.

If you pay through check, Melio will mail your funds within 5-10 business days.

I appreciate that Melio handles access control. Certain members of the team will now be able to access this. A manager can sign off on the salary for other employees if necessary.

Payment Processing

Invoices can be generated manually or integrated into accounting software. It’s easy to do this (integrations will come later).

It is simple for customers to pay when payment requests are sent with an invoice & a built-in “pay now” button.

You can save time using Melio, which automatically links payments to invoice numbers. This is a helpful feature if you own a business or work alone.

Bank transfers and credit cards are accepted by Melio. They accept Mastercard, Visa (personal credit cards not included), American Express, and Discover.

I believe Melio is safe. It keeps servers in SOC/PCI 1, 2, & 3 approved data centers under 24-hour surveillance and uses contemporary encryption techniques for payments and data transmission.

You will be at ease with data theft during payments because data is saved securely.

Melio also doesn’t protect credit card information on its servers. Instead, the most secure card processor, a Level 1 PCI Compliant Service Provider, is used.

Stripe Features

Let’s Compare Stripe Payments Features

Internation Payment

Over 135 nations accept and send money. Note that payment processing fees vary by location.

Making Payments

Stripe lets you split and send money. This is great for freelancers and contractors and straightforward to use. You may simply pay overseas contractors.

Payment Processing

Stripe’s payment processor is simple to install. It accepts more payment ways than Melio.

Customers can pay using Google Pay, Apple Pay, Microsoft Pay, & WeChat Pay, Click to Pay Bank transfers and debits, Credit/debit card, OXXO Klarna, Bank redirect, and Alipay.

Melio vs. Stripe: Integrations

Both software can be readily integrated with your existing bookkeeping software; the only question is, which additional services are compatible?

Melio

This is the list of accounting software that can be integrated with Melio: Xero, Microsoft Dynamics 365 Business Central, Quickbooks, and Freshbooks.

Stripe

Numerous eCommerce platforms are integrated with Stripe Payments, including Squarespace, BigCommerce, Zapier, Shopify, WooCommerce, Magneto, Xero & Quickbooks.

Melio vs Stripe: Pricing

Melio has no monthly fee. Paying by bank transfer using Automatic Clearing House (ACH) is also free.

Melio Pricing

Melio has a competitive fee structure. Details on outgoing payments:

- International USD Transfer – $20

- ACH (Bank Transfer) at no cost

- Expedited Check Delivery (using FedEx) – $20

- Same-day Bank Transfer – 1% fee

- 2.9% Debit Card Payment fee

- 2.9% Credit Card Payment fee

- Paper Checks – $1.50 (first 2 checks per month are free)

Fees for incoming payments are as follows:

- Same-Day Bank Transfer – 1%

- Credit Card Payment at no cost

- Bank Transfer – Free

Great incoming payments fee structure. Multiple small amounts overseas will cost more in USD transfers.

Stripe Pricing

Stripe Payments has no monthly fees. The base fee is 2.9% plus $0.30 for every transaction. Access the following:

- Fast payouts

- Reporting

- Optimized checkouts

- Compliance & Security

- Global payments

They also offer the reporting tool Sigma with a more complicated price.

Melio vs Stripe: Customer Support

Melio Customer Support

Starting off, making payments, receiving payments, and managing your account are all covered. They also offer guides for integrating accounting software.

At Melio, the customer service is good. Contact them by opening a ticket. Although I prefer phone support, Melio’s staff is accommodating and supportive.

Melio doesn’t have a customer support number. Use live chat or email.

Stripe Customer Support

The help center for Stripe Payments is complicated and challenging to use. However, there are a plethora of articles about platforms.

You can contact support via real-time chat, email, or phone. I like that they have a lot of leeway in making decisions, especially concerning important matters.

Melio vs. Stripe Pros and Cons

Melio Pros

- Cost-free monthly membership

- Competitive incoming payment rates

- Ability to delegate payment authority to a designated team member

- User-friendly

- The UI is clean and straightforward to use.

- Good onboarding

Melio Cons

- US Dollar transfer fees are on the high side for minor international payments.

Stripe Pros

- Great support team

- Easy invoice branding

- Good integrations

- Customer benefits include discounts, coupons & subscription plans

- Competitive transaction pricing

Stripe Cons

- Complicated then competitors

Related: Melio vs Quickbooks Online: The Ultimate Comparison

Melio Vs. Stripe: Best Alternatives

If you continue your search, the following is a list of payment gateways & processors you may want to check out.

1) PayPal

PayPal, as we all know, is a platform that is used by a large chunk of internet users all around the world and is considered to be quite large.

You may easily send invoices and make payments across international borders with this service offered in more than 200 countries worldwide.

You may learn more about this topic from my Melio and PayPal comparison article.

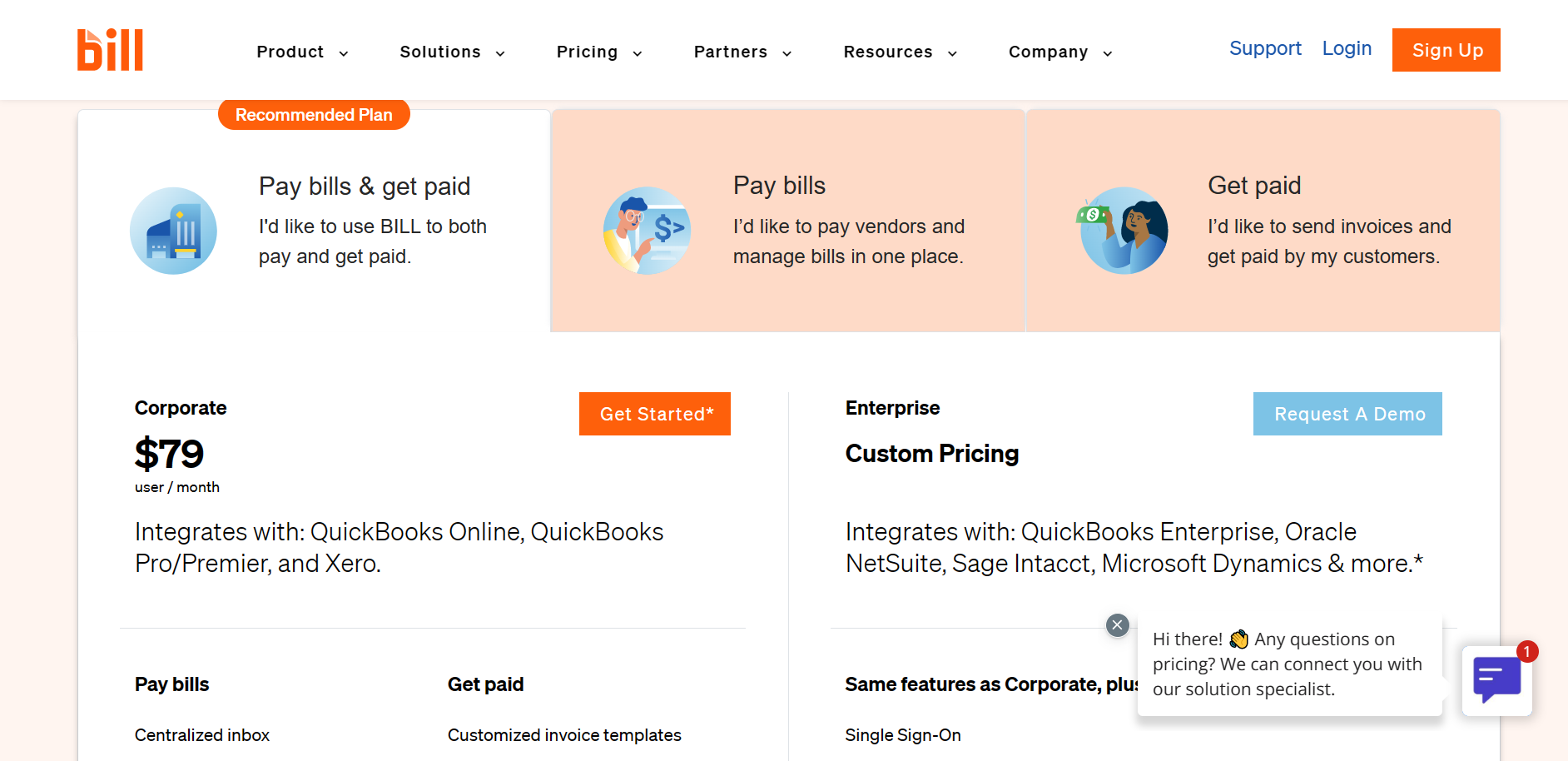

2) Bill.com

Bill.com is an excellent payment & billing method; however, it features more sophisticated accounts receivable & financial reporting tracking.

You may acquire additional information by reading my comparison of Bill.com and Melio.

FAQs

❓Can I cancel Stripe or Melio Payment easily?

You may cancel easily in each platform’s Accounts area. Not having a monthly subscription plan makes this easy.

❓Does Stripe or Melio have a mobile application?

Mobile apps for iOS and Android are available from Stripe. Simply manage payments on the go with this app. Melio has no mobile app yet.

Conclusion: Melio Vs. Stripe – Which is Best?

Choosing between Melio & Stripe is difficult for me. They’re poles apart in every way! However, Stripe Payments offers more flexibility and convenience.

The technology behind Stripe is reliable and suited to corporations of all sizes. Split incentives & payments for repeat customers are two other features I appreciate.

Melio is helpful, though, for smaller businesses and sole proprietors. Melio has a friendlier UI. Melio is intuitive and straightforward. The $20 foreign transaction fee might quickly add up.

Due to the absence of a subscription cost, you can try either service without risk. Doing this will help you figure out if they are a good fit.