Welcome to my Comparison between Melio Vs Bill.

A growing number of small businesses prefer to engage with independent contractors due to the potential financial benefits that they may offer. Yet, managing these kinds of external payments might be challenging when you can only write paper checks.

Due to this, many small businesses today employ online bill-paying services like Melio and Bill.com.

Accounts Payable (A/P) refers to the money your business owes suppliers. Your ability to manage these payments is helped by bill payment platforms. By using these services to mail checks, start wire transfers, and sometimes receive money, you can skip the inconvenience of writing actual checks on your own.

I will assist you if you need help deciding which product is best for paying your expenses. You can get all the information you need to make an informed decision between Melio Vs. Bill.com by reading on.

Bottom Line Upfront

Melio is more cost-efficient and user-friendly than Bill.com in comparison.

Melio streamlines bill payments and offers simple tools for organizations with basic financial requirements.

Your company’s size, complexity, and needs determine whether BILL or Melio is best for financial management.

Melio Vs Bill.com: Key Features

Melio Features

Many new and small businesses still use outdated, time-consuming, and expensive payment methods, but Melio is an excellent substitute. Melio is gaining more and more acclaim. This feature helps the service stand out since it makes it simple for businesses to create an uncomplicated payment page. Almost definitely the most tempting feature is the fact that the basic service is free.

Entry of data

Melio allows you to manually enter data or utilize your mobile device to scan bills. Although it may lack Bill.com’s bells and whistles, it is helpful and completes the task nonetheless.

Receivables Features

You may quickly and easily set up a website to accept payments with Melio. To request money from your partners, email them a link to your Melio.me page. This feature accomplishes its objectives despite being straightforward and devoid of automation.

Payables Features

According to its website, Melio is a great way to pay suppliers and contractors while minimizing expenses. On the other hand, Melio is a terrific way to receive client payments. The most appealing aspect of this platform is, without a doubt, the ability to use a credit card or debit card to make a purchase, even with merchants and partners that do not accept card payments.

The service would then ensure that your recipient receives either a physical check or a bank transfer to their account. In this case, you would pay Melio using your credit card (the complete transfer amount, no additional expenses for non-delayed client payments, etc.).

When using the Melio dashboard, you will have instant access to all your account payables.

Read Melio Review for Information.

Bill.com Features

Given its name, Bill.com is a leading pre-accounting software brand. It helps you manage payables and receivables, two essential business functions. It’s full service, but it’s pricier than other similar platforms.

Entry of data

Upload the bill by taking a picture with your phone’s app. This transfers most of your data to Bill.com’s dashboard. Import digital bills and let the AI fill up most data fields to save time.

Receivables Features

Your Bill.com dashboard shows all incoming and outgoing transactions. Create and send digital invoices to business partners quickly. Automated invoices might include customizable notes. This excellent method makes sending bills and tracking debt easy. Customers and business partners will appreciate the speed of online credit card or bank transfer payments.

Payables Features

Bill.com’s dashboard lets you track your bills in real time. You can send payments to your partners using the invoices they scanned and sent you. You can also set up automated and regular payments in a few clicks.

Melio Vs Bill.com: Integrations

Melio

The only platform that Melio presently integrates with for accounting is QuickBooks. Because of those above, besides partners from financial institutions, the Melio API is easily embeddable with other SaaS, B2B, and marketplace partners.

Bill.com

Bill.com integrates with popular accounting and finance stacks. If you’re using a service that doesn’t work well with Bill.com, you can quickly export highly compatible, easy-to-use templates. This works with Bill.com even if your service doesn’t.

Bill.com’s accounting integration is mostly two-way cloud sync. This maximizes time savings and convenience by updating data on both sides.

Bill.com has pre-installed QuickBooks, Xero, Oracle, Sage, and Microsoft connections. It works with Earth Class Mail, Expensify, Tax1099.com, Hubdoc, and Tallie, pre-accounting software.

Melio Vs. Bill.com: Pricing and other Fess

Melio

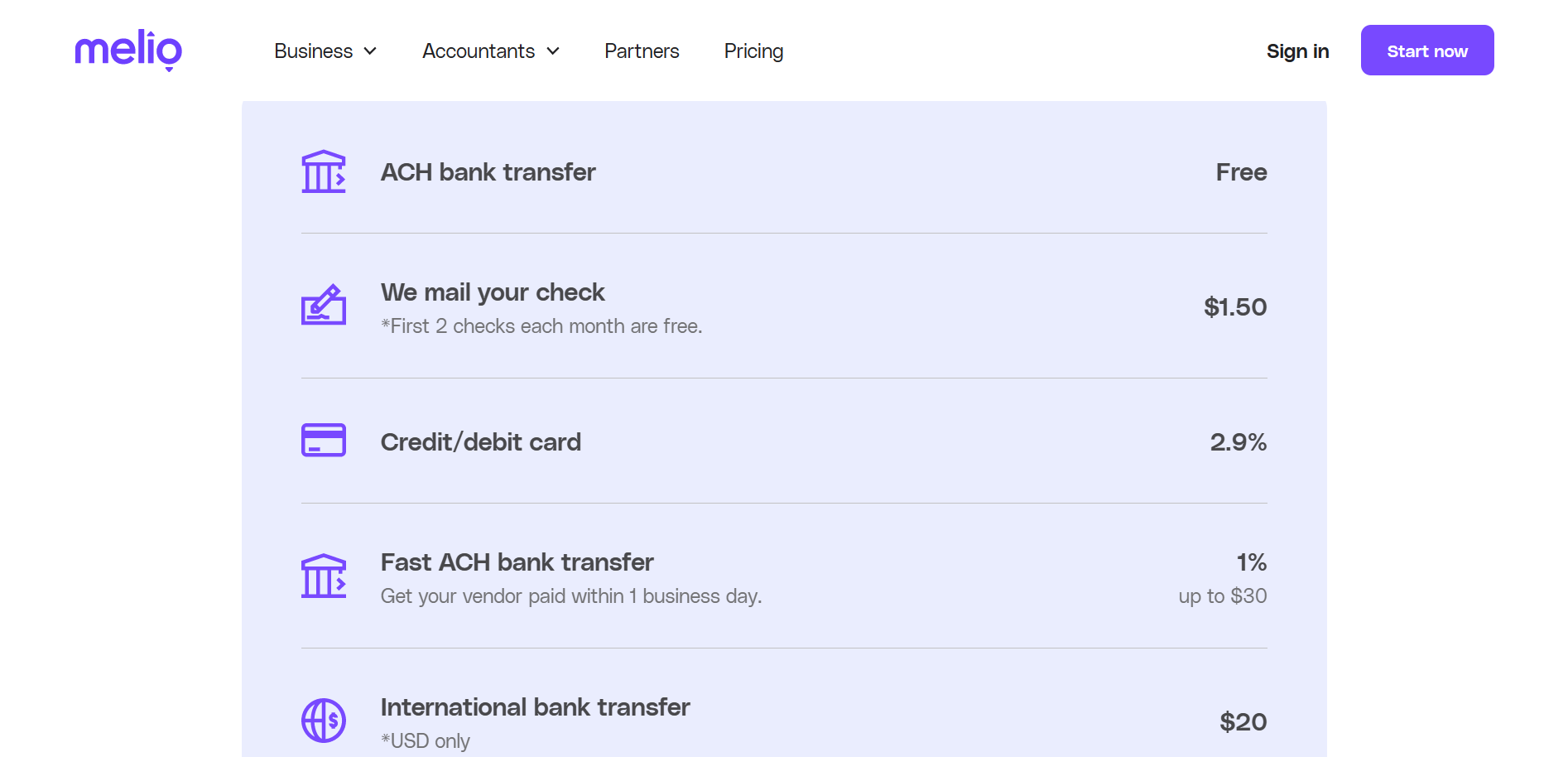

The main selling feature for most customers is probably that Melio does not charge any fees to its users. Using the service is indeed free in its basic form. No matter the nature of the transaction, the recipient is never charged. You will only have to pay extra money when you use extra services.

The only situation where you will be forced to pay anything to use Melio is if you decide to pay with a credit card and pick a payment delay option. The fee would equal 2.9% of the total transferred funds.

Bill.com

Bill.com offers premium programs and free demos. Pricing for Businesses and Pricing for Accounting Firms are the main options. Each must use either payables or receivables.

These plans per user come with a consolidated inbox, invoice scanning, Bill.com dashboard overview, unlimited document storage, ACH, check, international wire transfer, approval procedures, and up to six user profiles are payable features.

In receivables, it has customizable invoice templates, automatic invoicing, payment status tracking, automated email reminders, ACH and credit card payment support, and auto-charge and auto-pay. With the templates, you can export and import data to your accounting program and use those functions.

Try the BILL Accountant Partner Program, which lets you establish user roles for more than six users and add accounting interfaces like QuickBooks Pro/Premier and Xero. You must also choose between payables and receivables. User acquisition costs $49 per month.

The Corporate plan is the one that covers everything in the most detail. It contains all of the conveniences that come with the Team package, including payables and receivables. It can be purchased for a monthly fee of $79 per user.

Bill.com lets you receive payments, but “hidden charges” are added to the membership fee.

Bill.com Fees:

These fees are listed below:

- ePayment and ACH transactions cost $0.49.

- Standard postage costs $1.69 per check payment or invoice.

- Level 3 credit card processing charges 1.90 percent + ten cents.

- International wire transfers are free in local currency but $9.99 in USD.

- Vendor-direct virtual card payments are free.

- ACH payment guarantees same-day or next-day processing for $9.99.

- Overnight, two-day, and three-day check payments cost $19.99, $14.99, and $9.99.

Melio Vs Bill.com: Customer Support

Melio

During business hours, you can contact Melio’s customer service department by phone, email, or live chat on the corporate website. A library of tutorials is also available to teach you “the ins and outs of using Melio to digitize your AP&AR.” There is also a blog specifically for Melio where further resources are constantly discussed and distributed.

Bill.com

Users can connect with customer service on weekdays during business hours. Email us through Bill.com. The program’s videos, webinars, and how-to manuals can help you use your hands to solve problems.

Melio Vs Bill.com: Pros & Cons

Melio Pros

- About all of Melio is free

- User-friendly

- Scan Receipt

- even if the recipient does not accept payments made using a credit or debit card, one may still use one to purchase.

Melio Cons

- There are only a few native integrations available

- Basic accounts payables and receivables solution

- United States only

Bill.com Pros

- Importing digital bills and scanning and importing paper receipts is simple.

- Worked with a wide range of accounting applications.

- Organizes and centralizes all billing-related information

- Transfers can be made on the same day

Bill.com Cons

- The design is not the most refined

- A little expensive

- Perhaps it is too complex for usage by smaller businesses.

Conclusion: Melio Vs. Bill.com – Which is the Best Payment Solution?

Both payment solutions can help you keep track of your accounts payable and receivable, but how they do so differs for each one, as does the extent to which they help. A solid and complete professional pre-accounting and bill-paying solution is Bill.com. Online payments are also accepted by Bill.com. A great alternative called Melio has the same objectives but was created to be lighter and is mainly free.

The main selling points of Bill.com are the abundance of functionality, the diversity of integrations, and the range of automation. With all of its capabilities, it is an entirely free pre-accounting system. The most tempting aspect of Melio is that it is virtually free. Yet, it does a good enough job of handling the essentials.

The more powerful features that Bill.com has to offer are typically unnecessary if you manage a medium-sized business that doesn’t conduct much accounting or a tiny business that is cash-strapped. For now, stick with Melio.

You will find that using Bill.com to streamline your pre-accounting is pretty convenient and will save you a lot of time if you are overrun by incoming and outgoing invoices and feel that you are spending too much time on them.