Are you looking for an Unbiased Melio Review? Don’t worry; I’ve got you covered.

Do you own a small business in the US?

Are you looking for a platform that seamlessly integrates with QuickBooks?

Quickbooks is considered one of the leading accounting software in the world and is used by several businesses worldwide to manage accounts and transaction details. However, it is always recommended that online payment software be integrated with QuickBooks to make the flow of money even more organized and seamless.

However, while medium- and large-scale businesses can afford some advanced software that charges hefty subscription fees, small businesses, solopreneurs, and freelancers are always looking for something cheap.

If you are one of those people, we have a promising FREE solution to help manage your online bookkeeping and payment requirements. This is called “Melio”.

Melio Review: An Overview

Melio is a simple, straightforward bill-paying option for accountants, bookkeepers, and small business clients. A single dashboard and a single login for all client accounts enable businesses to handle the payments for all their clients.

Accounting teams can pay any business bill for free using a bank transfer or credit card, thanks to Melio. Businesses can add users, manage roles and permissions, and set up a payment acceptance pipeline with this software in just a few simple steps. Melio’s two-way sync with QuickBooks allows users to save time.

PROS & CONS

PROS:

- Setup and implementation are pretty straightforward with Melio. The instant sync with Quickbooks saves time.

- The client’s money can be deposited straight into a bank account with reasonable transaction fees.

- Credit card payment incentives, simplified payment tracking, and eliminating 1099 forms.

- ACH is free for customers to send, convenient to set up and use, and runs smoothly and cleanly.

- Bills are entered in QBO and synced with Melio, and payments are pre-authorized, so clients no longer have to worry about payables management or cash flow forecasting.

- Pay all bills without creating checks or mailing them.

- Integration with QBO streamlines and automates the AP and AR procedures.

CONS:

- Desktop users may find the web interface to be a bit clumsy.

- Lack of integration with other accounting software platforms like SAP, QB Desktop & Xero.

Melio Features at a Glance

With Melio, you can schedule payments in advance and set up automatic payments to eliminate late or premature payment concerns.

Additionally, you may invite users or your accountant to utilize the platform while maintaining total control over transaction approvals thanks to the platform’s payment approval protocols.

Here is a quick list of all the key features currently offered by Melio:

- ACH payment processing

- Billing & invoicing

- Approval process control

- Online payment processing

- Check processing

- Debit/credit card processing

- Duplicate payment alert

- Fraud detection

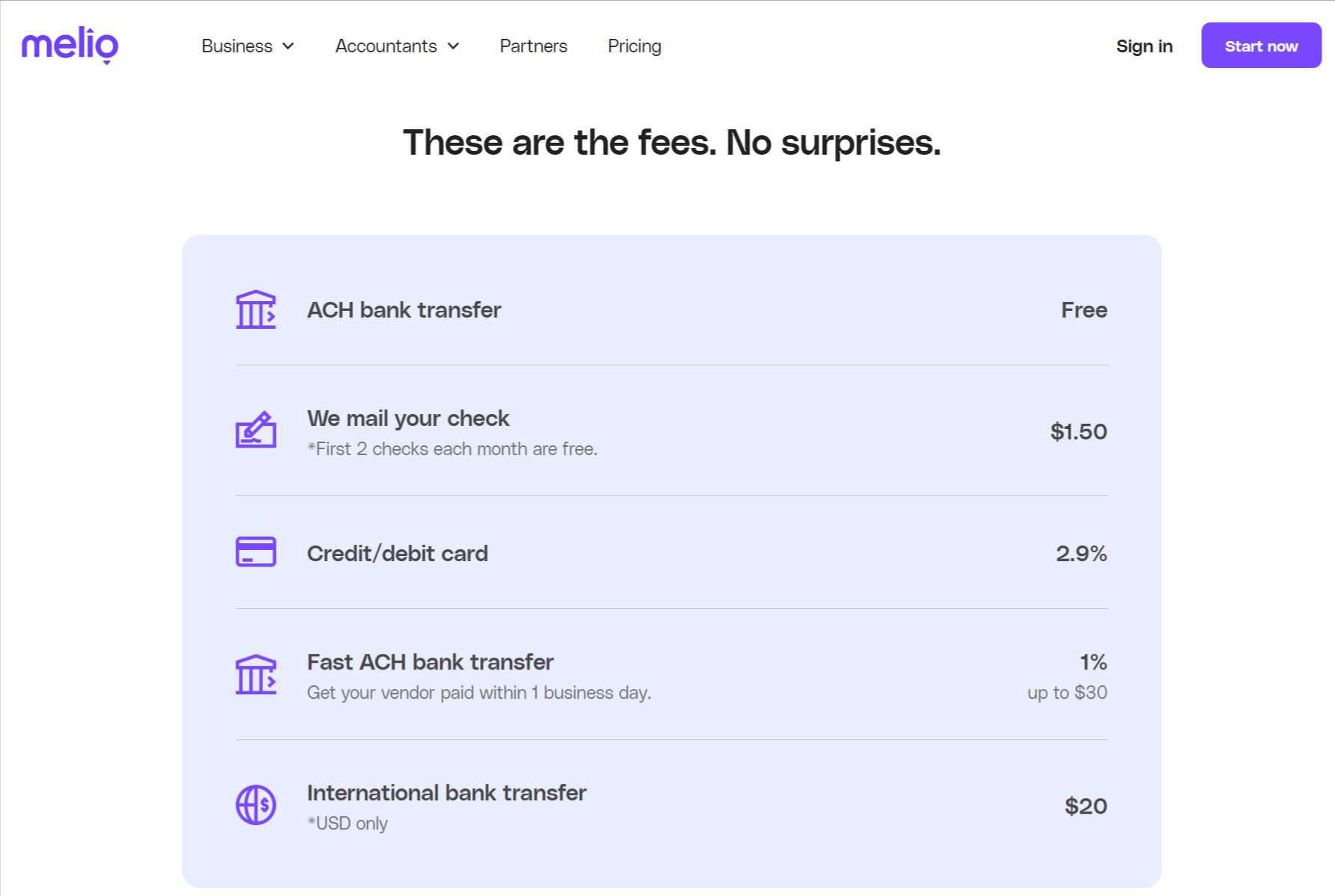

Melio Pricing Structure

Is Melio free?

The answer is a BIG CHUNKY YES!

The fundamental ideology behind creating Melio was to provide a unified platform for users who are low on budget to enjoy seamless money transfers between vendors. And if you are thinking that they offer cheap plans of pocket-friendly subscription tiers to attract users, you’re mistaken.

MELIO IS ABSOLUTELY FREE TO USE!

No subscriptions.

No signup charges.

No hidden costs whatsoever.

There are no setup or monthly subscription fees for accountants, bookkeepers, and small business clients!

So, if you are a Freelancer or solopreneur or own a small startup business and are looking for a free and stable solution to manage all your transactions with your vendors, then Melio is for you.

Just sign up and get your Quickbooks running in a matter of minutes.

No charges on Digital Payments

Melio allows your consumers or clients to pay you for nothing via card or bank transfer. You only need to register to receive your payment link, which clients may use to submit payments without knowing your bank information.

Your customer uses their bank or credit card to pay. They can send their payment without having a Melio account. Payments are made without charges or fees and transferred into your bank account in two business days.

Payment Options

On Melio, you have several payment alternatives. Examples include debit cards, credit cards, and bank transfers (ACH). Bank transfers are free of charge; however, credit card payments have a 2.9% transaction fee.

If a seller or store doesn’t accept credit cards, you can still pay using a credit card. Suppliers are paid by check or bank transfer, and Melio sends the check on your behalf. Sellers can accept your payment without having a Melio account.

Technical Support

Melio offers several technical support options in case you ever happen to run into any issues. You can contact their 24*7 support team via phone, email, and live chat.

You can even explore their knowledge base on the official Melio website, where you can get access to DIY blogs and training videos to help you solve some trivial issues yourself.

Best Melio Alternatives

Are you still unsure about Melio? Check out these top 3 Melio Alternatives.

1) Zelle

Zelle is a free, quick, and easy mobile payment software that lets you send money to people you already know and trust from your bank account.

Zelle is a quick and simple way to send money to friends and family, and it’s completely free.

This mobile peer-to-peer payment software can send money instantly from one bank account to another. It’s convenient for sending cash to a friend or family member.

The maximum amount of money you can send via Zelle is limited. You should check with your bank because they are the ones who establish the limitations.

The Zelle app has a weekly restriction of $500 for sending money across bank accounts.

2) Bill.com

Bill.com is a fantastic standalone accounting service that provides advanced management of accounts payable and receivable in addition to the choice to establish several approval levels for transactions. No other service offers a feature set as extensive or a workflow as sophisticated.

The four pricing tiers that Bill.com offers are as follows: For $39 per person per month, Essentials; for $49 per person per month, Team; for $69 per person per month, Corporate; and for $109 per person per month, Enterprise.

RELATED – Melio Vs Bill.com: Which is the Best Payment Solution?

3) Plastiq

With Plastiq, you can pay and collect payments for any bill online with a credit or debit card. This is an excellent option for earning rewards if you want to put purchases on a credit card but otherwise wouldn’t be allowed to. This includes some of your most critical recurring costs, such as mortgage or rent, car payments, and college tuition.

If you prefer not to pay these vendors directly with your credit card, Plastiq will send a check or wire transfer on your behalf. It also provides a global payments solution and an option tailored to smaller enterprises called Plastiq Accept.

The cost of using Plastiq may make you think twice about signing up. The 2.9% fee isn’t always unreasonable to factor into your decision.

If you are looking for a credit card sign-up bonus but cannot do it without making a sizable initial purchase, Plastiq is an excellent place to look. Depending on the size of the initial incentive, the cost of approximately $29 for every $1,000 paid could be worthwhile.

RELATED – Melio vs Plastiq: Which is a Better Choice for Your Needs?

Why do we recommend Melio?

Several vital aspects compel us to recommend Melio to users. I have listed a few of them below.

- Flexible payment alternatives

Melio enables payments by debit cards, credit cards, and bank transfers (ACH). While credit card payments are subject to a 2.9% transaction fee, ACH payments and bank transfers are free. Users can pay with them even in places where credit cards are not accepted.

- Seamless sync with QuickBooks

Dual data entry for all bills and payments is eliminated, thanks to Melio’s smooth two-way sync with QuickBooks.

- Payment approval workflows

Users can configure their roles and permissions and invite others and small business clients. Also, businesses control how each transaction is approved and may monitor their cash flow.

- Manned all bills and vendor details easily

By uploading files or snapping a picture of your invoice, Melio makes adding vendor and bill details simple. Connect the platform to QuickBooks online or manually enter the necessary information to sync your accounts payable data.

- No monthly subscription fees

Melio provides its accounts payable platform without charge because it was specially designed with freelancers and small enterprises in mind. There are no delivery fees when you mail checks to vendors, nor are there any monthly subscription fees that could consume a sizable portion of your money.

Frequently Asked Questions

How long does it take to get paid with Melio?

The processing of payments takes place just once each day, before 11:30 a.m. Eastern Standard Time. If a payment is entered after that time, it won’t begin processing until the next business day. The delivery time may be delayed due to federal holidays.

How does Melio make money?

Melio makes money when consumers use credit cards to optimize their cash flow or other payment methods (for a nominal cost), such as debit cards, checks, rapid ACH bank transfers, and overseas transactions.

Does Melio pay internationally?

Only U.S. dollars can be used for transactions completed outside the United States and its territories while using Melio. You can make payments to nations worldwide, including Europe, Asia-Pacific, South America, and more.

Who owns Melio?

Matan Bar, Ilan Atias, and Ziv Paz established Melio in 2018. The company has offices in both Tel Aviv, Israel, and New York, New York.

Also, Read:

- Melio vs PayPal: Which is the Best Platform?

- Melio vs Stripe: Which Is Better?

- Melio vs Quickbooks Online: The Ultimate Comparison

Conclusion – Is Melio Worth It?

Overall, we can conclude that Melio is an up-and-coming solution for freelancers and small businesses to manage payments and transactions with vendors effortlessly.

The best part? IT IS ABSOLUTELY FREE!

You may use Melio immediately on any internet-enabled device, such as your laptop or smartphone, and it is a powerful, free solution.

This is ideal for time-constrained business owners and professionals who want to pay their invoices and manage their cash flow on the move without blowing a sizable chunk of their budgets on pricey accounts payable software.

Furthermore, the software is smooth, user-friendly, and works very efficiently. It is elementary to use from Quickbooks.

Melio is one of the few platforms that support several payment options, such as bank transfers (ACH), debit cards, and credit cards. Bank transfers are free. It perfectly syncs with QuickBooks and also supports payment with any credit card or bank in the US.

Yes, that implies that the one major drawback of Melio, for now, is that it is only available in the USA. Another low point with Melio is that it currently only supports vendor payments.

So, if you are living or running your business outside the States and looking to deal with more than just vendor payments, you’ll have to look for other alternatives.

Otherwise, Melio is a great option. It’s free, so there’s nothing to lose if you try it!